We’ve all heard that advice… “Don’t get emotional about investing.” Well, the stock market is starting to turn very emotional, and that’s not a good thing.

Within a week we’ve seen the small cap stocks and banks rally more than 10%. Investors haven’t seen that in a long time.

At the same time, their favorite stocks – the Nasdaq 100 Index, NVIDIA, and every other AI stock – are falling like rocks.

That crosswind current does more to confuse investors, which can cost them a lot of money, unless you take the emotions out of the market right now.

Here are the two simple things that you need to watch today to slow this market down and make smart trading decisions…

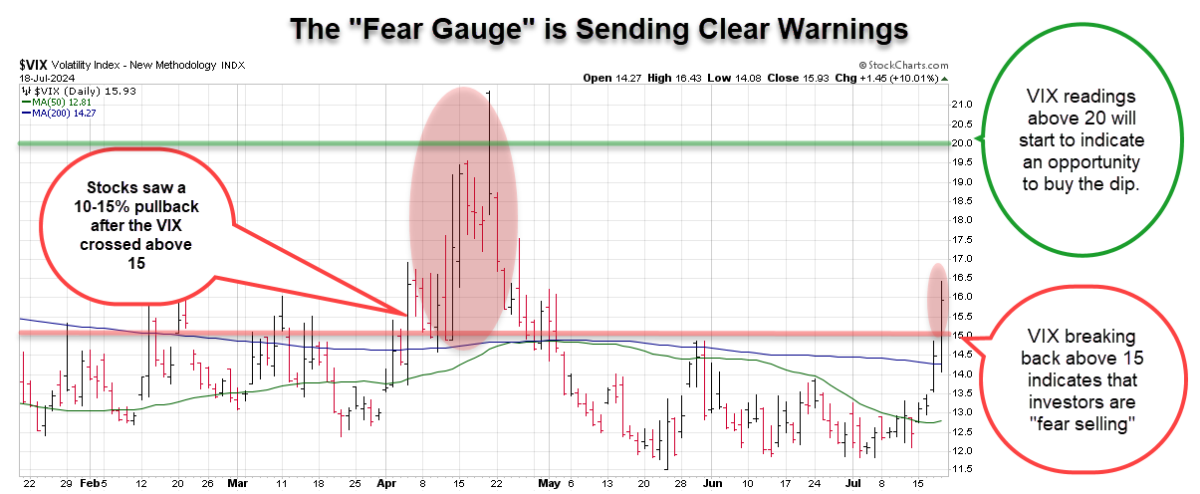

The CBOE Volatility Index, A.K.A. The “Fear Gauge”

The “Fear Gauge” is sending you a clear message.

Yesterday, the CBOE Volatility Index shot above the 15 level. This is the first time that the “Fear Gauge” had traded above 15 since April. Before that, the index broke above the 15-level last year, about this time.

Both times, the market dropped 10-20%. Why?

The VIX is known as the Fear Gauge because it tracks how much investors are paying for protection against a market decline. Think of it this way, it’s like homeowners going out to buy more insurance on their house when they smell smoke coming from the kitchen.

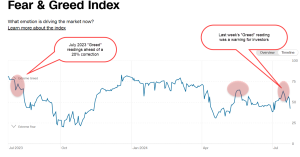

Warren Buffett taught investors to “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.”

The VIX is a great too to tell when the market is hitting those extremes.

We saw some of the lowest readings the VIX has seen in years in the last month. That was a sign that investors were too bullish on stocks.

Now, the VIX is moving higher, indicating that investors are getting more fearful of the market, and when that happens they sell stocks.

The selling stops when the fear hits a peak, which will be identified with a peak in the VIX.

Watch for a reading of 22-25 to identify when the fear trade has reached a relative extreme. That’s the time to start “buying the dip”.

NVIDIA is a Market Indicator

That’s right, I said NVIDIA is a market indicator.

On Wednesday I said that “if NVIDIA sneezes the market catches a cold”, and its true.

Few stocks rise to the level of NVIDIA in their time. Apple was an indicator in the early 2000. After that, Google.

Due to its success, NVIDIA is the one stock that investors think is infallible, so when it fails, investors question the health of the entire market.

NVIDIA shares are sitting at two critical technical levels.

First, the stock is doing a balancing act at $120. This price has supported NVIDIA stock three times in the last month.

When a single price supports a stock like that it becomes critical that the stock stays above that price. Break below it and investors start to sell. It’s an emotional reaction.

Just below that $120 level is NVIDIA’s 50-day moving average.

The 50-day is THE most watched technical trendline. It’s the one trendline that embodies the phrase “the trend is your friend”.

A break below $115 will send NVIDIA shares into a selling spiral as emotional traders will start to press the “sell” button simply because they’re not sure what’s going on with the stock.

Bottom Line: A break below $115 for NVIDIA will trigger a wider selling spree in the market.