Stocks are starting to show signs that their longer than normal rally is in dire need of a rest.

After months of relentless – and sometimes blind faith – buying, the Nasdaq 100 and S&P 500 are showing signs of a “triple threat” that is emerging.

This isn’t the first time that we’ve seen this Triple Threat, and it won’t be the last, but the results of this situation are almost always the same.

Take a few minutes to digest the threat and what it may mean for your portfolio as we get ready to close the month of July and head into what is normally a high volatility, low return period of the year.

Threat One: Complacency

Complacency is one of the most dangerous threats a market can face.

Call it whistling by the graveyard, call it kicking the can down the road, call it what you want… it’s bad for stocks.

Complacency happens when investors just expect that things will go well. That sentiment means that they fail to prepare for any adverse conditions until it’s too late.

Hint: it’s not too late, but we’re getting close.

You need to look no further than Tesla (TSLA) to know that investors have become complacent in the current market.

The year started poorly for Tesla as the company saw a notable slowdown in their EV sales. Sure, the trade winds had turned against them as there were more competitors in their space and less in the way of Government incentives, but we heard a message from the company’s management… Things will get better fast.

Last quarter, the company turned in a terrible earnings scorecard, but Elon Musk teased investors with a lower priced model possibly by year’s end and ratcheted up the rumor mill on the company’s unreleased Robotaxi product.

Investors took the hook and bought the stock to the tune of an 80% rally in three months. Forget about the weakening consumer, a slowdown in China and the EV market. Forget about the Cybertruck’s woes…. Just whistle past the graveyard and buy the stock.

COMPLACENCY!

That’s just an example.

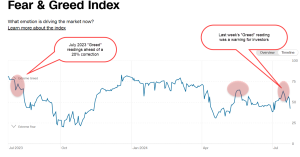

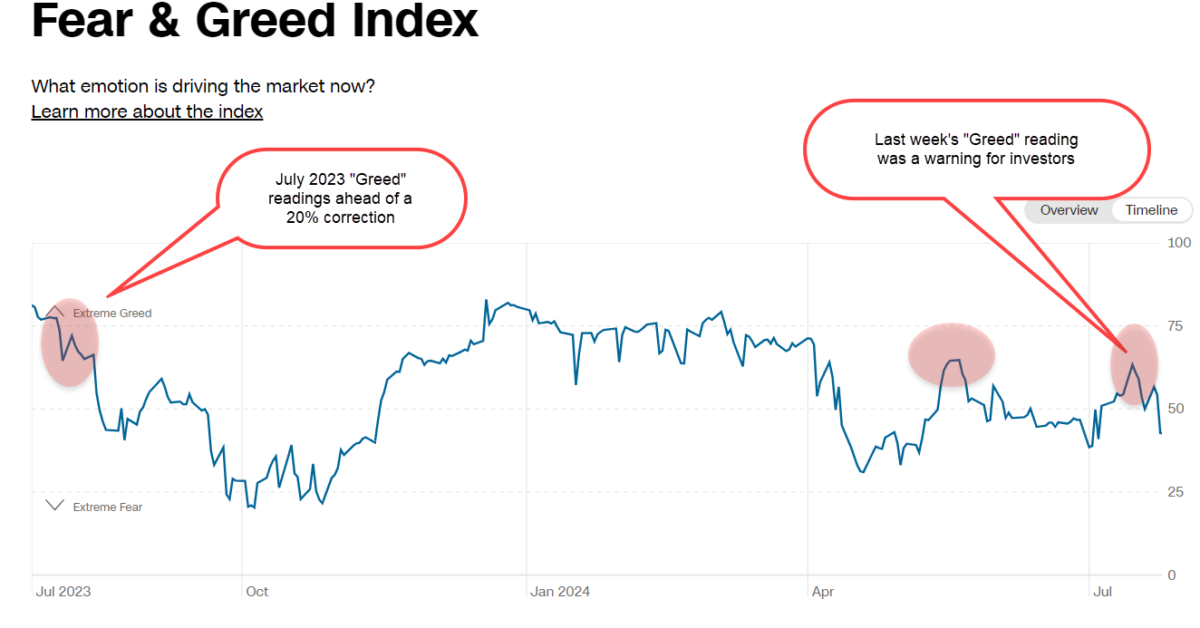

Just one week ago, the CNN Fear & Greed Index returned to “Greed” readings.

The reason, simple. Everyone got excited about interest rates coming down, possibly as soon as next week’s FOMC meeting.

Forget about the fact that the market was heading into the heart of earnings season with some of the highest expectations we’ve seen for corporate earnings in years.

Forget about the fact that 25% of the S&P 500 is trading in a bear market along with 30% of the Nasdaq 100 (we’ll talk more about that tomorrow).

Here’s your bottom line: Complacency turns to fear and selling as soon as volatility is introduced into the market. July was the quiet before the storm.

Threat Two: Seasonality

I just mentioned that July has been the “quiet before the storm”. Here’s the data that shows that this is a trend, not a situation.

Note that the four months in which the earnings seasons start are the best months of the year for S&P 500 seasonality.

Now take notice that the months of August and September have been the worst months for being invested in the markets over the last 20 years.

Take this as a warning.

Sure, the Fed is going to come out next week and hint that interest rates are going to come down before the end of the year, and investors will get excited about buying stocks for a week or two.

But just like its hard to change the stripe on a zebra, it’s just as hard to break the seasonality trends.

Please maintain a cautious approach to stock in the month of August.

Threat Three: The Magnificent Seven

This threat could also be filed under “complacency”, but the fact is that these stocks have the potential to bring real risk to the market on their own, and they’re preparing to do just that.

The table below display’s a quick technical review of the Magnificent Seven Stocks.

This is the leadership, these are the names that everyone has bought and these are the names that can trigger widespread selling if/when they start to see dramatic selling and technical weakness.

Two weeks ago, all seven of these stocks were trading above their respective 50-day moving averages, today only two hold that title.

The earnings results for these seven companies are now starting to roll in, and despite some positive news, the first blush reaction is that the reports aren’t likely to meet the high expectations set by Wall Street. This means that significant selling pressure may cone to bear on these stocks, even if their earnings results meet The Street’s targets.

I used the term “priced for perfection” just a few days ago, all seven of these stocks are exactly that, which is often a warning sign for the market.

What To Do Now

The last week has been a subtle “call to arms”, not necessarily “the fight”.

There are a lot of investors that have been waiting to put cash to work in the market on the first sign of a “correction”. Now is the time to put that “wish list” together with prices at which you want to buy your “wish list stocks”.

I’ll have a short list of my Wish List Stocks for you on Friday along with target buy prices.

Those of you that are fully invested may want to consider either taking profits or hedging your portfolio using protective puts or inverse index ETFs.

The Nasdaq 100 will be the more widely targeted index for selling due to the inclusion of the Magnificent Seven and other high-flying technology stocks.

The small cap Russell 2000 Index is likely to see the least selling as investors have started looking for value opportunities in this area of the market ahead of the Fed’s lowering of interest rates later this year.